September 23, 2022

As a business owner, setting up a webshop is a natural first step to boost sales. But to accept payments, you’ll need a payment gateway that processes every single payment made on your website. Let’s dive into how payment gateways exactly work, and why it’s crucial to have one in order to keep your business growing.

What is a payment gateway? ⛩️

A payment gateway is the crucial link between your webshop and your customers while processing any payment. It securely validates your customers’ payment details (more on this later) and allows you to get paid the amount displayed on your website.

With plenty of “invisible” steps in the process of accepting payments, a payment gateway serves as the link between your business and your customers.

Why need a payment gateway at all? 🤷

There are several reasons why webshop owners need to integrate a payment gateway to start accepting payments. If you picture online payments as physical ones, you’ll quickly see the problem. When you are physically there in a shop to authorize any payment, you sheer presence does the trick, and there’s no need for additional authorization. The same cannot be said about online payments, though.

When your customer checks out on your webshop, there’s no telling that, just by entering any credit card data, that person is actually authorized to initiate the transaction. Payment gateways are also gatekeepers of your customers’ payment data. They serve as a middleman, but they also add a security net for every payment. In short, you need a payment gateway because of the following reasons:

Authorizes payments. This is sort of a no-brainer. Your webshop by its own is not allowed to authorize any kind of payment made by credit or debit cards or any other payment methods like bank transfers or e-wallet (Apple Pay and Google Pay) transactions.

Keeps things secure. In an age when online transactions are getting increasingly exposed to fraudulent activities, webshop owners need to think about payment safety as well. The easiest way is to integrate gateways that take care of monitoring fraudulent behavior and if needed, block transactions.

Provides a smooth experience. Payment gateways generally make the otherwise complex process of online payments quick and easy. They take little effort to integrate and come with additional benefits like analytics tools, several payment options, and more.

Once you get started with payment gateways, it’s time for you to decide which type of integration you prefer. While picking the right one, be mindful of the following:

How much developer work does it require? Some need less, and some need more, but either way, make sure you have the resources before committing to any of the implementations.

How about PCI compliance? The Payment Card Industry needs you as a merchant to pass a Self-Assessment Questionnaire (SAQ) depending on the type of gateway integration.

Can I customize its appearance? If branding is important for you, you’ll like certain integration types better than others.

What types of payment gateways are there? 🗒️

If you cleared the above questions, you can move on to leafing through the various payment gateway types. Generally speaking, there are 4 different approaches to gateway implementations:

Offsite gateway: This is a pretty common type of payment gateway integration. After checking out on your website, the customer is directed to a secure page where they can enter their payment details. Once the payment is authorized, your customer is redirected to your webshop. This solution uses the payment gateway provider’s branding elements, although it does allow for basic customization via CSS. No PCI SAQ is required.

In-line gateway: This is also a widespread implementation. As its name suggests, your customers can pay for your products on your own webshop. On top of that, this solution gives you a wide range of customization options on your gateway integration, allowing you to fit the gateway in the webshop design-wise as well. PCI SAQ A is required.

Onsite gateway: There’s just a tiny difference between in-line and onsite gateways. The latter gives you the same implementation, except that it appears in the form of a pop-up. It basically embeds an HTML page (in this case, the secure page for payment) in your webshop. PCI SAQ A is required.

API-only gateway: This gets you the smoothest integration as checkout looks exactly as if it were done on your page. Your customers won’t get to peek under the hood, and you can personalize this page as much as you want. Looking at developer working hours, this is also the most resource-heavy option. PCI SAQ D is required.

How do payment gateways work? ⚙️

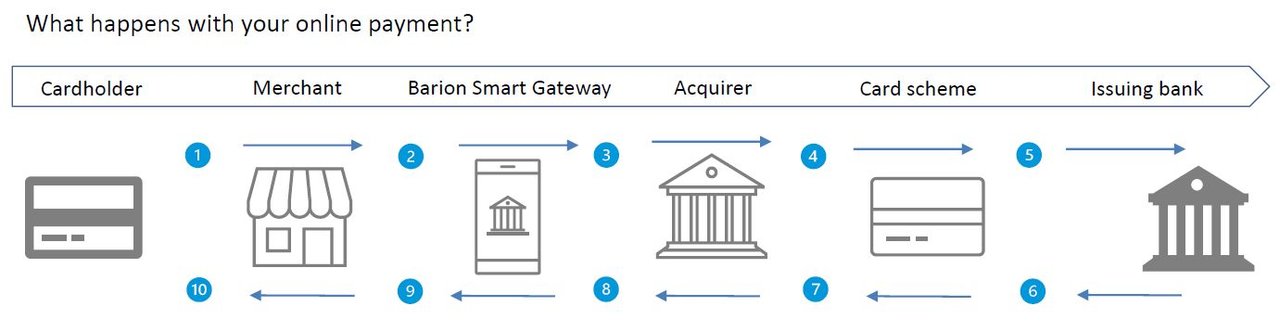

Now that you know everything about the what and the why, it’s time to delve a bit deeper and understand the how. So far, we’ve introduced the two ends of the equation – you, the merchant, and your customers – with the payment gateway in the middle. As we zoom in, however, you’ll see there are a few more parties involved in the process:

The acquirer: This is the bank or payment institute that hosts your credit card’s processing account.

Card scheme: This is a paid service (like Visa or Mastercard) that sets the rules and infrastructure for processing payments.

The issuer: This is the bank that issued your customer’s credit card.

As you see, from the moment of checkout all the way to accepting the payment, there are many steps:

While this might seem like a lot, it takes about 2 seconds. The entire process with its 10 steps is done without your customer noticing anything about it. Your payment gateway plays a crucial role both ways: it sends the payment details ahead to the issuer for approval, and then receives it back, allowing you to actually get paid for the goods you sold a few seconds before.

Why choose Barion Smart Gateway as a payment gateway? ✨

With several gateway providers out there, Barion Smart Gateway offers a payment gateway that’s unique in its own right. Merchant fees (this is what you pay per transaction) start from 1.5% and can be as little as 0.5%. Integrating Barion Smart Gateway is a smooth process as well. If you’re using a popular e-commerce platform like Shopify or WooCommerce, you can simply use a pre-made plugin for that – or if you’re thinking about a custom integration, your developer will love it to bits.

Barion Smart Gateway is known for its low-effort integration: even if you go with the custom option, you can set everything up and hit the ground running in mere days.

As of today, Smart Gateway supports offsite gateway integration: this means that your customers will be directed to a secure page for entering payment data, and then redirected to your webshop once the payment goes through.

Sound good? Pick Barion Smart Gateway as your payment gateway provider and take the first step now:

More like this

Guide

September 14, 2022

This is how you become a Barion merchant

Unbeatable fees, better insights, and a smooth integration process: these are just a few of the reasons why business owners choose Barion Smart Gateway for accepting payments. So, how do you open a shop at Barion?

Guide

October 25, 2022

The ultimate guide to becoming a Barion merchant

From the first steps to going live, this is your ultimate guide to becoming a Barion merchant.

Guide

November 11, 2022

The Barion API: designed with developers in mind

A good payment gateway is one that takes minimal effort to integrate.

Facebook

Facebook Discord dev community

Discord dev community @BarionPayment

@BarionPayment