October 10, 2022

●

Digital wallets are becoming more than just hip apps we can flash while paying at our local shop. But what is a digital wallet, how does it work, and why do webshop owners like yourself should not even hesitate to accept payments via them? And, most importantly, how do they help you get better conversion rates? Explore all these and more in our extensive guide about digital wallets.

What is a digital wallet? 👛

A digital wallet is an online payment tool. It’s basically a virtual duplicate of an existing physical credit or debit card – although sometimes there might be only a digital version of it. It comes in various shapes and sizes, but in general, most digital wallets can be accessed via an app on your phone or other gadgets.

Why do customers prefer digital wallets? 🤷

Let’s start with the obvious: the greatest perk of a digital wallet is that you don’t need to carry your cards around. A digital wallet can store multiple credit and debit cards, and even more: e-tickets, vouchers, and documents can be all squeezed into it.

But there’s much more to it. When it comes to online payments, it literally takes no more than a single tap or click to make a payment. This beats traditional credit cards by a mile, as your customers don’t need to enter their card details anymore, nor do they have to go through any verification process. Let’s not forget about the fact that certain digital wallets don’t even require your customers to have a physical bank involved in the process of maintaining a bank account. This helps you as a business owner connect with potential customers even easier.

On top of these, there’s the matter of security: even if a phone (or whichever device stores credit card details) is lost or stolen, said credit card details cannot be accessed as they are not stored in the app itself. This brings us to our next question:

How do digital wallets work? ⚙️

A digital wallet – and the card details stored in it – uses software to wire payment details from your bank account connected to the given card to your online store. It uses a method called tokenization: your customer enters their credit card details in the digital wallet’s app, which translates sensitive data (in this case, card details) to non-sensitive data (this is called a “token”). Thanks to this method, whenever this customer checks out in your webshop, by choosing their preferred digital wallet, they can initiate the payment with a single click or tap.

What type of digital wallets are there?📱

There are three types of digital wallets, and their different features are clean-cut.

Closed wallet: These wallets are issued by a company, usually an e-commerce store, and while the customer can top up their wallets, they can only spend their funds within the closed ecosystem of the issuing company. One such example would be Amazon Pay.

Semi-closed wallet: These wallets allow customers to pay online or offline only at certain merchants. You as a business owner first need to enter an agreement with the wallet issuer. Semi-closed wallets also come with a limited coverage area, so businesses with cross-country audiences will not see many benefits of adopting such payment methods.

Open wallet: These wallets are issued by banks through banks or companies. This type of wallet is the most widespread, and most of the well-known providers' issue open wallets.

Which digital wallets are most widely used? 🔝

There are plenty of options out there, with most providers either exclusively issuing digital wallets, or having them as part of their wider product range. The most prominent ones are as follows:

Google Pay: In 2019, Google Pay logged a transactional value of 110 billion USD.

Apple Pay: Not counting China, Apple Pay has the largest transaction volume globally.

AliPay: Processing over a whopping 17 trillion USD, they are the largest mobile payments platform in the world, mostly available in China but not in Europe.

PayPal: A long-time player in the industry, PayPal has over 400 million active user accounts.

Barion Wallet: A trusted player in the CEE region, Barion Wallet currently has over 400k users.

There are several other major players, but most of them either don’t have a foothold in Europe (like Venmo) or focus on a specific market (like WeChat).

Why does my webshop need to accept digital wallets?🤷

This is sort of a no-brainer, and we’d go as far as to say that the question is not why, but when. According to the Global Payments Report, almost half (48.6%) of e-commerce transactions (value-wise) were done via digital wallets in 2021. Credit cards come in at second place – with 21%. The jury is still out as to how it changes by 2025, but the earlier figure is expected to grow to 52.5%. But it's not only market trends we can point to as a reason for adopting digital wallets.

According to Big Commerce, digital wallets can triple your conversion rate. There's no big secret here: your customers often find themselves in comfy situations when pulling out a credit card and entering all its details is a hassle. Who wouldn't want a single gesture to authorize payment in cases like this? Naturally, digital wallets decrease the number of abandoned carts, thus boosting your conversion.

At this point, having digital wallets as a payment option on your website is no longer just nice to have. On the contrary, it’s a lifeline to your business as customers rapidly ditch other online payment methods in favor of their favorite digital wallets.

Add the previously explored market trends, and it’s easy to admit that global trends show growing adoption rates everywhere – so even though European numbers stay relatively low, customer needs to paint a different picture. Digital wallets are conquering the world of online payments, and staying on the outside can be costly for any business in the long run.

Digital wallets and Barion Smart Gateway ⛩️

If you are planning to integrate Barion Smart Gateway as a payment gateway for your webshop (or you already have it), you’ll be able to offer digital wallet payments to your customers. Barion currently supports payments via Google Pay, Apple Pay, and Barion Wallet, covering the bulk of digital wallet payments in Europe.

Barion also has its own digital wallet solution, called Barion Wallet, which has over 400k users. Plus, Barion Wallet is being used for 3% of transactions at certain companies, making it a popular payment choice at checkout. With this tool, customers can perform most account-related actions for free: registering, saving credit cards, sending money to other Barion Wallets, and making online payments all come without a price tag. As for express top-ups (1%) and wire transfers (0.5 EUR), there’s only a minimal fee charged.

More like this

FinTech

November 30, 2022

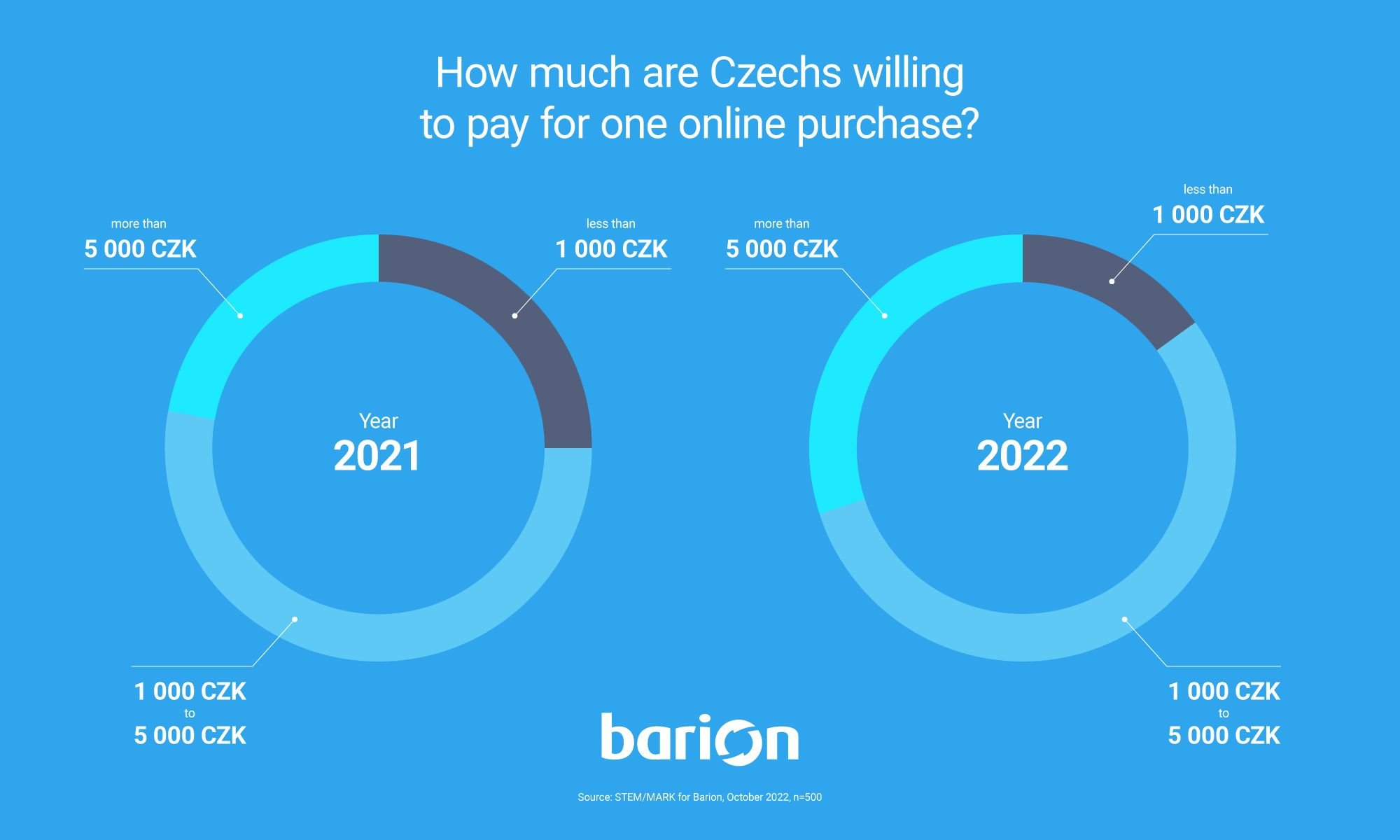

The latest online payment trends in the Czech Republic

Catch up with the latest trends and tendencies of the e-commerce sector and digital payments in the Czech Republic.

FinTech

October 28, 2022

How do payment gateway providers hide their fees?

Transaction fees, monthly subscriptions, no flat rates - payment providers have many options to hide their fees. We listed them all to help you make the best offer on the market.

FinTech

November 21, 2022

What is a virtual IBAN and how does it help your business grow?

How do virtual IBAN account numbers help you with foreign money transfers and why do they make digital wallets even more powerful?

Facebook

Facebook Discord dev community

Discord dev community @BarionPayment

@BarionPayment